Everybody’s talking about it, at least in the mortgage industry. Despite a worldwide pandemic, mortgage companies blew through existing records for mortgage refinance volume in 2020. Let’s take a look at mortgage refinance stats from last year (including our own poll), how LOs achieved their incredible volume, the expectations for this year and the tools mortgage companies can use to stay ahead.

Mortgage Refinance in 2020

GET STARTED TODAY

Give Surefire a Try!

The best way to find out what we offer is to try it out yourself. We’re confident that you’ll like what you see.

You’ve heard that 2020 was an unprecedented year, right? After mortgage and refinance rates hit record lows a total of 16 times in 2020, “unprecedented” is no cliché when it comes to mortgage refinances.

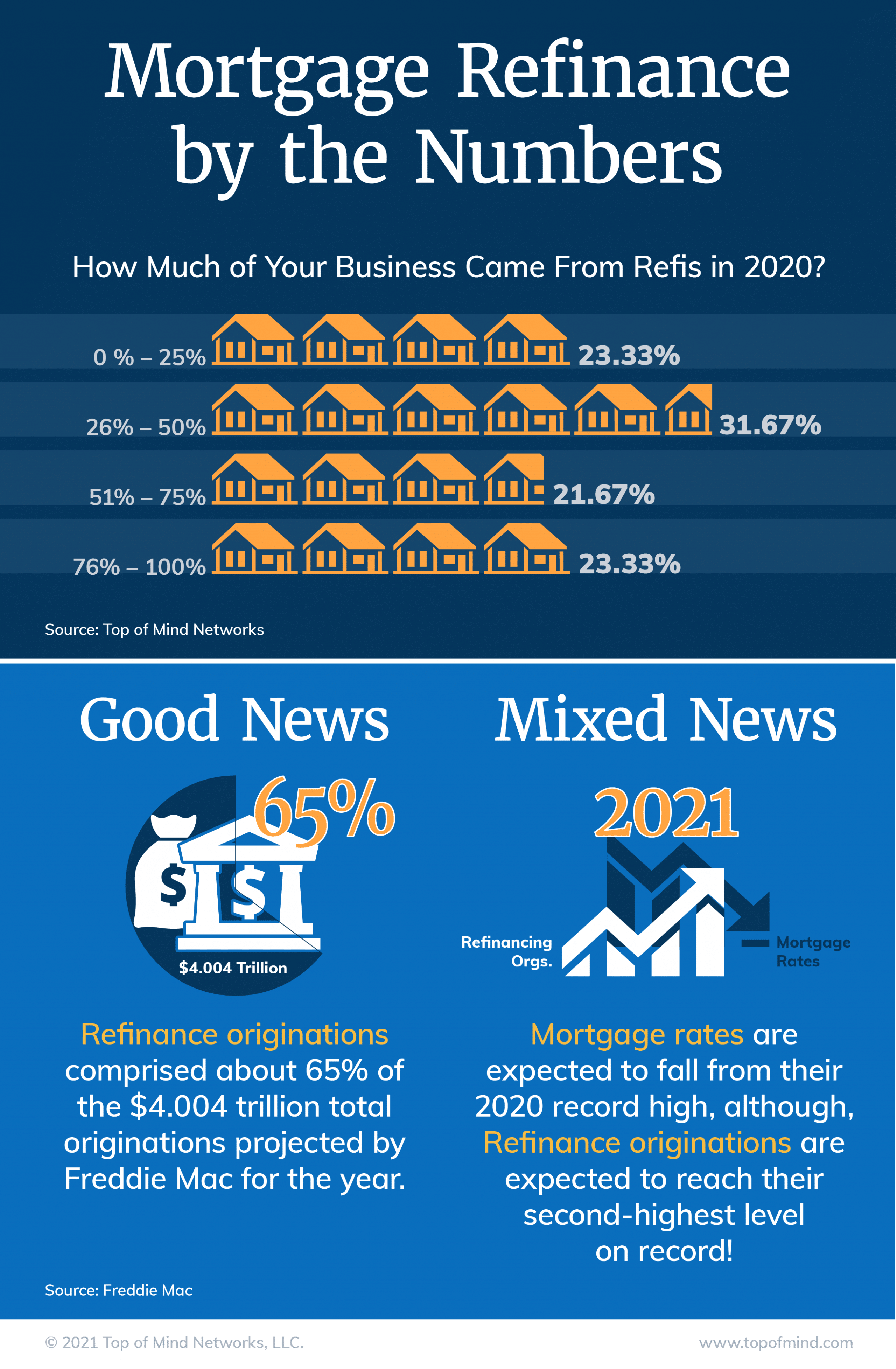

Freddie Mac projects $2.585 trillion in refi originations when final 2020 numbers are tallied. This is the highest number on record and is more than double 2019’s $1.130 trillion mark. Refinance originations comprised about 65% of the $4.004 trillion total originations projected by Freddie Mac for the year.

The other 35% of the total cannot be overlooked. Freddie Mac estimates purchase originations totaled $1.419 trillion, 9% higher than 2019’s $1.303 trillion.

Top of Mind polled industry contacts in January and February, and 55% reported that mortgage refinances comprised less than half of their 2020 closings. Those results show that lots of LOs built their businesses on the strong purchase market. The year was about far more than refinancing.

How did they do it?

Reading these staggering refi stats is one thing. But living through their creation? Loan officers across America did it, and they have the battle-weary smiles to prove it.

Closing such a high volume of mortgage refinances and purchases would be difficult any year. When you add in a pandemic; social distancing; working and schooling from home; and the overwhelming nationwide experience of sickness and loss, “difficult” doesn’t come close to describing the feat mortgage companies accomplished.

Fortunately, mortgage marketing technology made it possible (combined with the skill, determination, and grit of thousands of mortgage professionals, of course).

For example, online notary services enabled a swift move to online and hybrid closings. Loan Origination Systems provided a means for loan milestone tracking and management among remote team members. And Surefire, the best mortgage CRM, offered a one-stop-shop for directing leads, managing databases, and handling compliant communications with borrowers before, during and after the loan process.

And how does mortgage refinance look for 2021?

There’s good news and bad news. The bad news is that mortgage rates are expected to be back in the 3s during 2021, and refinances are expected to fall from their 2020 record high. Don’t be alarmed – even the high 3s is not even close to a high interest rate, so the good news is that refi originations are still expected to reach their second-highest level on record!

(By the way, it’s not just low fixed rates that will drive those numbers. We’re imagining a lot of people who spent way too much time at home in 2020 are going to look at a cash-out refinance for some home improvements in 2021!)

And there’s more good news. The Mortgage Bankers Association (MBA) forecasts this year will be a strong one for purchase originations, home sales, and new housing starts. In fact, purchase originations are expected to overtake refinances as the leaders, with an expected record-setting year of their own in 2021. Looking at the numbers – that’s a projected $1.628 trillion in purchase originations for 2021 compared with $1.547 trillion last year. The agency expects refinance originations, in comparison, to hit $1.385 trillion.

MBA forecasts overall mortgage originations – refinance and purchase combined – to fall from 2020’s total, but still reach the second-highest level in the last 15 years.

Just how busy will LOs be? To reach the forecast total in originations, MBA anticipates the industry will close about 9,200 loans in 2021. That’s less than the 12,000 closed in 2020, but mortgage companies will still need strong strategies for managing the pace.

And how will the mortgage industry make it happen?

Battle-weary LOs and the teams that have their backs have learned from experience. Most have the technology in place to beat this year’s goals, just as they crushed last year’s.

And what can that technology do? Companies that choose Surefire CRM adopt technology that can:

Alert them of loans ready for a refi based on rate comparisons (there will still be plenty of refis to go around!)

Integrate with a partner like Blend to monitor a loan applicant’s progress as they reach different application completion stages and alert the LO if the applicant stalls.

Manage incoming leads with triggered responses and notifications, as well as round-robin lead distribution.

Automate workflows, including client communications and team member tasks, for prospects, in-process borrowers, and post-close clients.

Provide high quality, on-target content, such as homebuyer education; in-process communication; timely industry news; a full slate of interactive tools, such as mortgage payment and refinance calculators; and lighter fare for holiday or birthday greetings.

Help build those important relationships with referral partners – more important than ever in a purchase market – with cobrandable content and ways to share value in order to meet RESPA requirements.

Create cobranded Single Property Sites in moments by uploading property photos and details directly from an MLS listing, then use them to print flyers, provide touchless check-in at an open house, present loan options, and provide unique neighborhood information.

Meet compliance requirements with editable content, approval management systems, self-audits, and strong customer support.

This, of course, is a short list of the ways Surefire CRM can help manage record-breaking volume in 2021. To learn more and see it in action, schedule a demo today.