How to Use Your CRM to Host a Successful Networking Event

Dec 20, 2023Networking events are an important way to begin and enhance working relationships with both potential clients and referral partners.

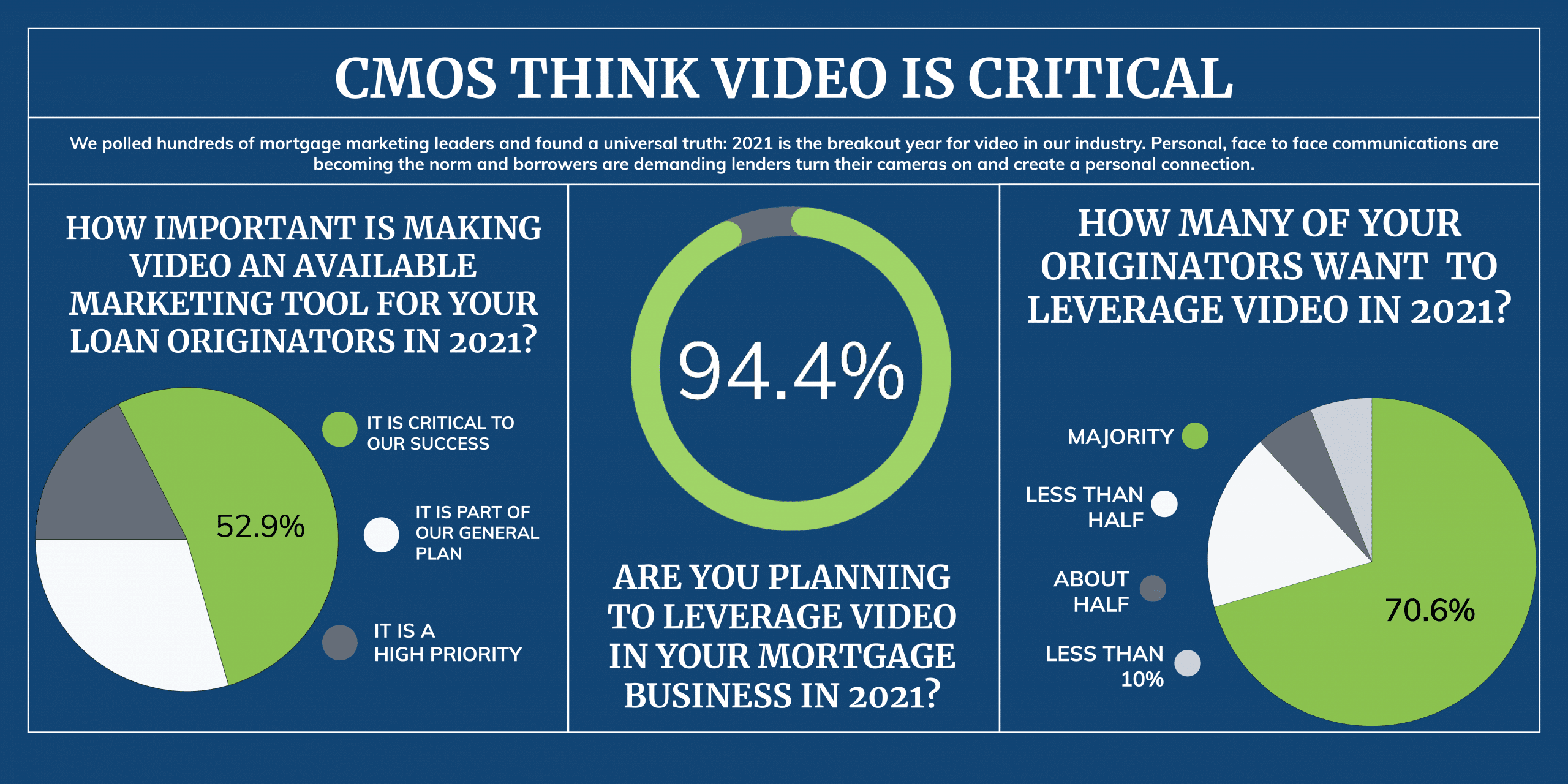

Content is essential to a great mortgage marketing strategy. And among the different types of creative content, mortgage video marketing reigns supreme. Mortgages today are driven by digital interactions, and video provides lenders with an excellent channel in which to engage and educate new borrowers.

Unlike other types of businesses, mortgage lenders have factors that they must consider before producing video content. Continue reading to learn the facts of implementing a mortgage video marketing strategy.

This Article Covers:

Video marketing offers mortgage professionals the opportunity to deliver business messages, educate borrowers and introduce their corporate brand identity through various marketing channels.

Regardless of the video’s length, format and style, any mortgage marketing video’s end goal should be to deliver information on your corporate brand or specific lending product.

Video marketing provides mortgage lenders with an endless supply of opportunities to showcase their business, whether through social posts or even longer borrower case studies.

To create a solid digital mortgage marketing strategy, lenders need to bring videos to their marketing strategy’s frontline. With the rise of video sharing services like YouTube and social media channels like Facebook and Twitter, incorporating videos has never been more crucial.

Need more convincing? According to Facebook IQ:

The key to developing a solid video marketing strategy is to make the most efficient message promoting the action you want your prospects to take in the shortest amount of time.

You can accomplish this by creating an outline of your video’s goal. Start with these three questions to figure out the goal of your video marketing strategy:

Once you have your goal in mind, you can move onto developing your message. This is where knowing your audience is critical as it determines the way you will present your information. The message you deliver should take your audience on a journey that sets your brand as the central protagonist.

The final step in creating a video marketing strategy is determining what channels you’ll distribute the video through. Each of these channels may require different considerations from file size to video content, impacting how you film and produce your video.

It may come as a shock to you, but video marketing is not a one-size-fits-all marketing strategy. Different types of videos can be used to accomplish different goals. Currently, there are four types of videos that mortgage lenders should implement in their digital marketing strategy, including:

Educational/Explainer Videos

Educational videos can be an excellent tool for keeping your current customers happy and on schedule at each stage of the loan process. These videos will make you a subject-matter expert, and lenders are likely to refer your videos to their friends and family. Whether providing information on the do’s and don’ts of the loan process or updating a potential borrower on how to repair their current credit issues, educational videos are a new necessity for successful loan officers.

Commercials

There are pros and cons to using commercials in the mortgage industry. While they can generate new leads to keep your lender pipeline full, they can easily create compliance issues depending on the content.

Testimonials/Case Studies

Testimonials humanize and elevate your brand by using a message from your previous customers rather than your corporate office. As with commercials, there are considerations you’ll need to understand to remain compliant with state and federal regulations.

Webinars

For mortgage lenders, webinars can be an educational, promotional, case study video experience all in one. But what many mortgage professionals fail to understand is that a webinar is not a single-use video. Often sections of the information presented in these interactive recording sessions can be used in several future communications.

Producing a video is only the first step of implementing your video marketing strategy. The next step is to choose the proper distribution channel for your video.

When selecting distribution channels, mortgage lenders choose between either owned media channels or paid media channels. For the best returns, many lenders opt to choose a mixture of the two.

Owned Channels:

Owned media is a term that refers to any media channel which your brand owns. This can include any of your social media accounts, website, or email marketing platform.

Paid Channels:

As the name implies, paid media requires an additional cost to distribute your video through paid search ads, social media ads, sponsored content, and advertisements on non-owned websites.

While publishing your videos on owned channels does not require any additional investment, you should consider paid media if your video content aims to source new leads who are not already familiar with your brand.

While the metrics for your videos will be determined by the channels you used to distribute them, there are three main factors you should consider when evaluating the results of your mortgage video marketing.

Views

Your video view tracks how many unique contacts clicked to view your video. In this metric, you should also review the number of times your current contacts clicked to view the video.

Engagement

Engagement tracks the amount of time each of your viewers devoted to watching your video. It is unlikely that every viewer will watch your video in its entirety, so you’ll want to review the average time spent with the video to determine if you may need to shorten the message or introduce your call to action sooner.

Action

The action in your video is all about what your contacts did post-watch. Did they click the link you wanted, did they call one of your loan officers for more information, or did they visit your website afterward? Consider all of these actions a success when implementing video marketing.

The expansion of mortgage video marketing’s capabilities presents an excellent opportunity for mortgage lenders to increase their market share. As borrowers continue to prefer a digital lending experience, video stands as the gold standard for lenders to engage with new and repeat customers. Mortgage professionals are prioritizing video content that reaches a broader audience on their mobile devices. The longer you wait to implement a mortgage video marketing strategy, the more customers you’ll lose to other mortgage companies.

This is why Surefire CRM, the leading mortgage marketing automation platform, offers our Power Video tool. With Power Video, mortgage lenders can create effective face-to-face communications with customers and prospects without any need for extra software. Using Power Video, lenders can quickly shoot videos in Surefire, which can then be deployed immediately, or scheduled for later, in emails or text messages.

Surefire also offers an extensive library of animated videos that can be used for any number of needs within your mortgage business, ensuring that you have the tools to implement a video marketing strategy backed by the best mortgage CRM.

Get instant access to tried-and-true mortgage marketing strategies and guides with Mortgage Marketing University.

See how Surefire effortlessly develops content tailored to your brand. Sign up for a free look book today.

You have what it takes to be a top mortgage lender and Surefire has what it takes to get you there. Learn How!

Networking events are an important way to begin and enhance working relationships with both potential clients and referral partners.

Ad conversion rate measurement helps LOs gauge the effectiveness of their marketing spend. Surefire mortgage CRM can boost those metrics.

Credit union marketing strategies can benefit significantly if marketers utilize content designed from the start to foster engagement.