Will your borrowers even remember your name in a year? How about five years? Probably not–more than half of homeowners switch agents on their next transaction. Add the Client for Life Workflow for Surefire CRM to keep your past clients close for that refi, second home, or house upgrade down the road.

Client for Life Campaign

Are You a Post-Close Marketing Powerhouse?

Check out our birthday card subscription and let Surefire send your personalized birthday cards!

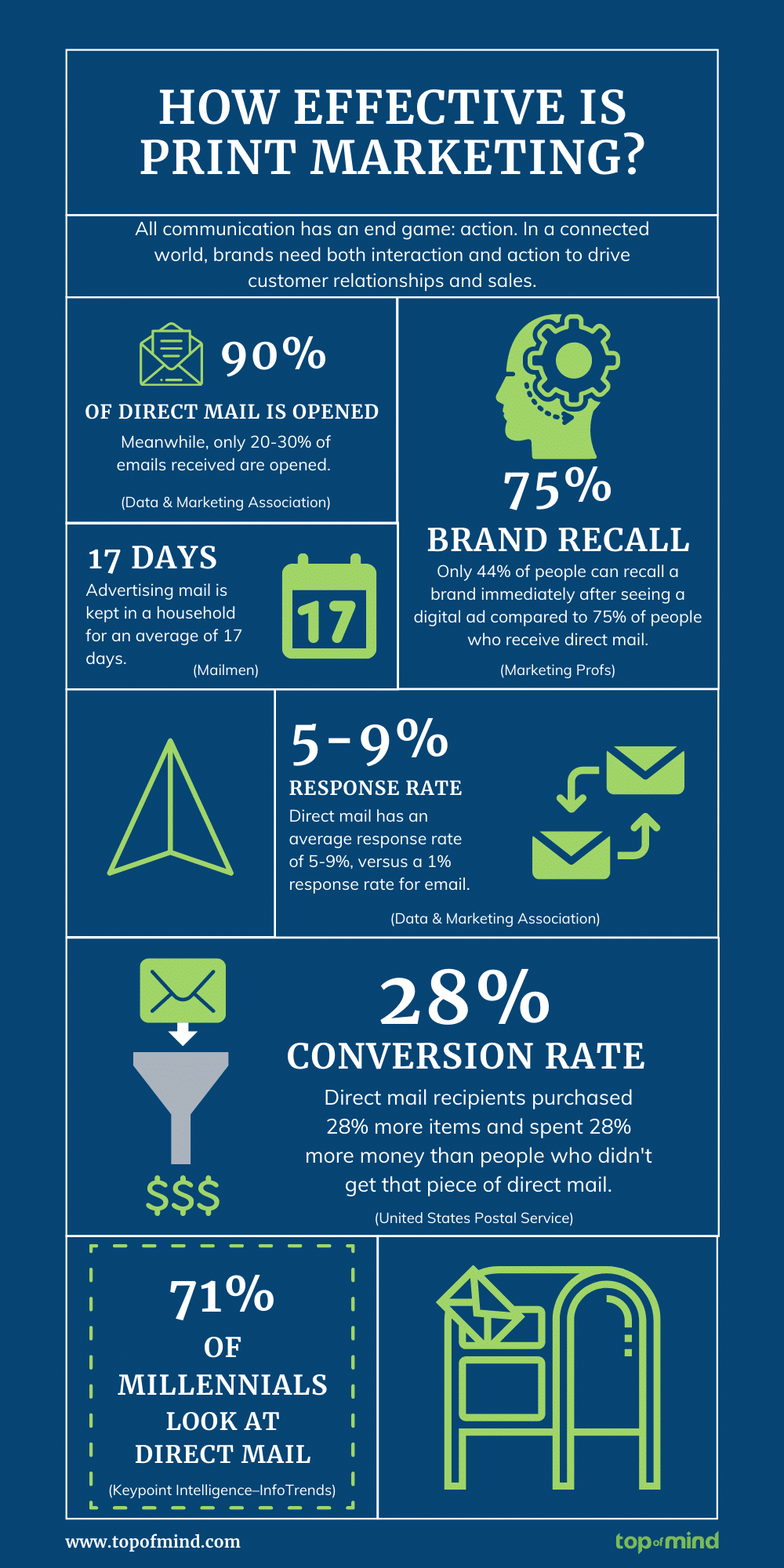

Perfectly Balanced Multi-Channel Marketing

Are you just sending email? How exactly do you plan to stand out in the sea of sameness? Add some sizzle with interactive media, timely thoughtful greetings, text messaging, a survey, printed postcards with award winning imagery, and a personalized post close gift! Your key to edging out the competition, keeping your clients educated and informed, and beating those internet lenders is to stay Top of Mind with your borrowers throughout your lending career. Our Client for Life Campaign will accomplish that—over and over—for years to come.

Does it Pay to Spend Money Post Close?

The post-close workflow is designed to generate repeat and referral business. As you know, it can cost up to 5X more to get a new customer than it does to create repeat business.

We find that our clients enjoy a 5x reduction in customer acquisition costs by using a post-close campaign.

You’re smart to be doing the math. Organizations find that after adding up the costs of buying, writing, stamping, addressing, and mailing cards manually – even if you could remember who to communicate with and when to send them, your time is worth a lot more than a few cents saving on hard costs. In fact, if while running out to buy stamps, if you miss an important call from an agent or a client, it could cost you more in the end.

Since our post-close workflows have success based pricing, our most successful organizations have built-in their post-close campaign costs right into their fee structure.

Check out our selection of branded closing gifts that help build your business!

The Surefire Retention Center

For homebuyers and even those homeowners who have just closed on a refinance, their transaction seems monumental. In fact, the cliché phrase of it being the largest financial transaction of their lives rings true in almost every instance. And indeed, a finance or refinance is not typically a small feat, especially in their eyes.

You’re an integral party to making that transaction happen!

Marking what will often be a more celebratory inkling on their side with the addition of a more conventional housewarming gift is a greater and grander way of saying, “Thanks for your business! I’m happy to have helped.”

The best closing gifts for borrowers go beyond merely thanking them for their business and help build repeat and referral business.

The Retention Center is an online retention gift store.

The Retention Center enables loan originators to curate a custom gift-receiving experience for clients in lieu of or in addition to corporate-level client retention initiatives.

Within the Retention Center, LOs can build automated retention gift campaigns based on rules, such as loan type (refinance or purchase), loan amount and occasion. Once a retention gift campaign has been activated, Top of Mind dynamically customizes, professionally packages and ships the retention gift to its recipient.

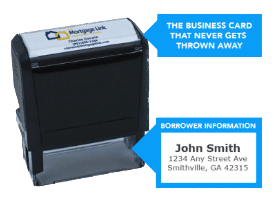

The Ideal Gift Has Longevity

The ideal gift is useful, bears your name, and is common enough of a household item that almost everyone can and will appreciate. Finding the perfect personalized gift doesn’t have to be hard. In fact, it’s effortless with the Surefire Retention Center.

Retention Center gift options include bamboo cutting boards, premium whole-bean coffee, a self-inking address stamper and dynamic birthday cards. Book a demo to learn more!

Already Have a Post Close Campaign?

Congratulations! But so does everyone else. The key concept is perfectly balancing cost with effectiveness. You have to stand out, but you have to also control costs. Are you experimenting on your borrowers? Instead, draw on our near 20 years of experience delivering massive returns on post close campaigns.

Oh–and content matters. Award winning content is not an accident, and your team won’t be able to prove what works the best without years of trial and error. Work with the Surefire CRM Client for Life Campaign and you will be using one of our proven Blueprints for Success, which have filled our clients’ pipelines for decades.

Reach Out to Request a Client for Life Demo

Explore the Surefire programs and services that are game changers for small broker teams and

large, independent mortgage bankers alike.

MORTGAGE MARKETING UNIVERSITY

Free Ebook

Get instant access to tried-and-true mortgage marketing strategies and guides with Mortgage Marketing University.

SEE YOURSELF IN SUREFIRE

Custom Look Book

See how Surefire effortlessly develops content tailored to your brand. Sign up for a free look book today.

SUREFIRE CRM

Get the Demo

You have what it takes to be a top mortgage lender and Surefire has what it takes to get you there. Learn How!

Connect with Top of Mind on Social Media

Our team is on the cutting edge of news, information and technology in the mortgage industry. Connect with us to stay up to date on the latest mortgage news and information.